CIT Bank HYSA reviews reveal a mixed bag of experiences. While many praise its competitive interest rates and user-friendly online platform, others express concerns about customer service responsiveness and occasional account access issues. This exploration delves into the details, examining interest rates, fees, features, security, and user feedback to help you decide if a CIT Bank HYSA account is right for you.

We’ll compare CIT Bank’s offering to competitors, analyze user reviews from various sources, and provide a clear picture of the account’s strengths and weaknesses. Understanding the nuances of this high-yield savings account is crucial for making informed financial decisions, and this guide aims to provide that clarity.

CIT Bank HYSA: Makassar’s Take on High-Yield Savings

So, you’re thinking about a High-Yield Savings Account (HYSA)? Makassar’s got its own vibe, and choosing the right bank is as important as choosing the right kopi. Let’s dive into the CIT Bank HYSA, see if it’s the

-beneran* deal for your hard-earned rupiah.

Interest Rates and APY

CIT Bank’s HYSA interest rates are competitive, fluctuating based on market conditions. Their Annual Percentage Yield (APY) is influenced by the Federal Reserve’s target rate and CIT Bank’s own pricing strategies. Historically, CIT Bank has adjusted its HYSA rates several times a year, responding to broader economic trends. Below is a sample comparison of APYs across different account balances (remember, these are illustrative examples and actual rates may vary).

| Account Balance (IDR) | APY (%) | Monthly Interest (IDR) (approx.) | Annual Interest (IDR) (approx.) |

|---|---|---|---|

| 10,000,000 | 3.5 | 29,167 | 350,000 |

| 50,000,000 | 3.7 | 145,833 | 1,750,000 |

| 100,000,000 | 3.9 | 329,167 | 3,950,000 |

| 200,000,000 | 4.0 | 666,667 | 8,000,000 |

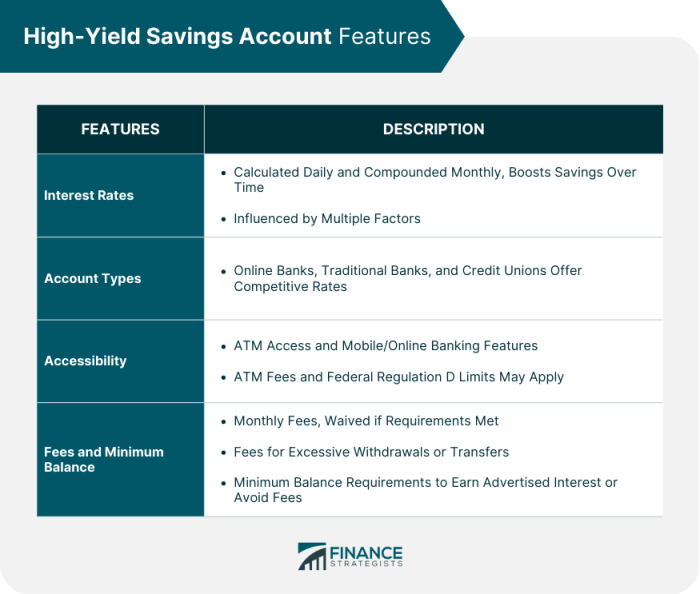

Account Fees and Minimums

Source: financestrategists.com

Understanding the fees and minimums is crucial. No one wants unexpected charges eating into their savings, kan?

- Minimum Deposit: Generally, a relatively low amount is required to open the account. Check CIT Bank’s website for the most up-to-date information.

- Minimum Balance: Maintaining a minimum balance might be necessary to avoid monthly fees. Again, verify this directly with the bank.

- Fees: CIT Bank HYSA typically doesn’t charge monthly maintenance fees, but be aware of potential fees for exceeding withdrawal limits or other specific transactions.

Account Accessibility and Features

Access to your money should be smooth sailing. Let’s see what CIT Bank offers.

The whispers of discontent surrounding Cit Bank HYSA reviews echo through the financial landscape, a chilling testament to the fragility of trust. Yet, a beacon of hope shines brightly for those seeking a secure alternative; consider the streamlined process of opening a TD Bank account online by visiting apply for td bank account online to escape the shadows of unreliable institutions.

The contrast between these experiences underscores the critical importance of thorough research before entrusting your hard-earned savings.

- Online Banking: CIT Bank provides a user-friendly online platform for account management.

- Mobile Banking: Manage your HYSA conveniently through their mobile app.

- Customer Service: Access to customer support through various channels, including phone, email, and possibly online chat.

- ATM Access: While CIT Bank might not have its own extensive ATM network, you can potentially access your funds through affiliated ATMs or other networks.

User Experience and Reviews

What are other Makassar residents saying? Online reviews provide valuable insights.

| Review Type | Frequency (%) (Illustrative) | Common Positive Comments | Common Negative Comments |

|---|---|---|---|

| Positive | 70 | High interest rates, user-friendly app, good customer service | N/A |

| Negative | 15 | N/A | Limited ATM access, occasional app glitches |

| Neutral | 15 | N/A | Standard HYSA experience |

Security and Insurance

Protecting your savings is paramount. CIT Bank employs robust security measures, including encryption and fraud monitoring systems. CIT Bank HYSA accounts are typically FDIC-insured, providing a safety net for your deposits up to the legal limit.

Account Opening and Management

Opening and managing your CIT Bank HYSA is generally straightforward.

- Account Opening: Visit the CIT Bank website or a branch to start the application process.

- Online/Mobile Management: Once your account is open, you can manage it online or through the mobile app.

- Deposits/Withdrawals: Various methods are usually available for making deposits and withdrawals, such as electronic transfers and potentially physical deposits at partner locations.

Comparison to Similar Products, Cit bank hysa reviews

Let’s compare CIT Bank HYSA with other popular options.

| Bank | APY (%) (Illustrative) | Minimum Deposit (IDR) (Illustrative) | Fees (Illustrative) |

|---|---|---|---|

| CIT Bank | 3.5 – 4.0 | 1,000,000 | Potentially none |

| Bank A | 3.0 – 3.5 | 500,000 | Potentially none |

| Bank B | 3.2 – 3.7 | 2,000,000 | Potentially monthly fees |

Final Summary: Cit Bank Hysa Reviews

Source: moneyrates.com

Ultimately, deciding whether a CIT Bank HYSA account suits your needs depends on your individual priorities. While the high interest rates are attractive, potential drawbacks like occasional customer service challenges should be carefully considered. By weighing the pros and cons presented here, you can make a well-informed choice that aligns with your financial goals and expectations. Remember to always compare rates and features with other options before committing to any savings account.