Apply for TD Bank account online? Euy, it’s easier than finding a good rujak buah in Bandung! Seriously, opening a TD account online is a breeze. We’re gonna walk you through the whole process, from filling out the forms to actually using your shiny new account. No more lines, no more waiting around – just pure, unadulterated banking convenience.

So, you wanna open a TD Bank account online? Totally doable! But before you dive in, maybe check out the fine print on other banks, like the minimum balance requirements; for example, you might want to look into the cit bank savings connect minimum balance to see how it compares. Then, get back to that sweet TD Bank online application – you got this!

This guide breaks down everything you need to know, from the documents you’ll need (don’t worry, it’s not a mountain of paperwork!) to the security measures TD Bank has in place to keep your dough safe. We’ll also compare online vs. in-person applications, because hey, choices are good, right? So grab your laptop (or handphone!), and let’s get this show on the road!

Applying for a TD Bank Account Online: A Comprehensive Guide: Apply For Td Bank Account Online

Source: thesmartinvestor.com

Opening a TD Bank account online offers convenience and speed. This guide details the process, security measures, and troubleshooting tips to ensure a smooth and secure experience.

TD Bank Online Account Application Process

Applying for a TD Bank account online is a straightforward process. The user-friendly interface guides you through each step. The process typically involves completing an online application form, verifying your identity, and funding your account.

- Navigate to the TD Bank website and locate the “Open an Account” section.

- Select the desired account type (checking, savings, etc.).

- Complete the online application form, providing all required personal and financial information.

- Upload required identification documents (e.g., driver’s license, passport).

- Review and confirm your application details.

- Receive a confirmation email or message upon successful application.

- Fund your account via electronic transfer or other specified methods.

A typical screen during the application process might display a progress bar indicating the completion percentage and a clear indication of the next required step. Another screen will show a summary of the account details before final submission, allowing for a last chance to review the information. The final screen displays a confirmation message and next steps.

Required Information for Online Application

Accurate and complete information is crucial for a successful application. The following information is typically required:

- Full legal name

- Date of birth

- Social Security number (or equivalent)

- Current address

- Contact information (phone number and email address)

- Initial deposit amount

- Employment information (for certain account types)

Comparing TD Bank Account Types and Online Application Processes

TD Bank offers various account types, each with its own features and online application process. The core process remains similar, but specific requirements may vary.

| Account Type | Online Application Process | Minimum Deposit | Features |

|---|---|---|---|

| Checking Account | Standard online application | $0 | Debit card, online banking, bill pay |

| Savings Account | Standard online application | $25 | Interest-bearing, online banking |

| Money Market Account | May require additional verification | $1,000 | Higher interest rates, check-writing privileges |

| Certificate of Deposit (CD) | May require additional documentation | Variable | Fixed interest rate, term deposit |

Required Documentation for Online Application, Apply for td bank account online

To verify your identity and prevent fraud, TD Bank requires specific documents. Ensure they meet the specified format requirements.

- Government-issued photo ID: Driver’s license, passport, or state-issued ID. Acceptable formats: clear, high-resolution JPG, PNG, or PDF. Verification involves comparing the uploaded image with database records.

- Proof of address: Utility bill, bank statement, or government document showing your current address. Acceptable formats: clear, high-resolution JPG, PNG, or PDF. Verification involves confirming the address against other provided information.

- Social Security number (or equivalent): This is usually verified through internal systems and databases. No specific format is required beyond the standard SSN format.

Security Measures During Online Application

TD Bank employs robust security measures to protect user data. These measures include encryption, multi-factor authentication, and fraud detection systems.

TD Bank’s security protocols are comparable to those of other major banks, utilizing industry-standard encryption and security practices. They continuously update their systems to adapt to evolving threats.

- Use a strong, unique password.

- Be cautious of phishing emails or suspicious links.

- Ensure you are on the official TD Bank website.

Troubleshooting Common Application Issues

Several issues can arise during the online application process. Understanding these issues and their solutions can prevent delays.

- Incorrect information: Double-check all information for accuracy before submitting.

- Document upload errors: Ensure documents are in the correct format and size.

- Technical difficulties: Clear your browser cache and cookies, or try a different browser.

Helpful tips include: using a reliable internet connection, ensuring your device is up-to-date, and carefully reviewing all information before submission.

Post-Application Procedures

After submitting your application, you’ll receive confirmation and instructions on account activation.

If you encounter issues, contact TD Bank customer support via phone, email, or online chat. Their contact information is readily available on their website.

A flowchart illustrating the post-application process would show: Application Submission -> Confirmation Email -> Account Activation -> Account Access. If problems arise, a branch to “Contact Customer Support” would be added.

Comparing Online vs. In-Person Application

Both online and in-person application methods offer advantages and disadvantages.

| Method | Advantages | Disadvantages | Time Required |

|---|---|---|---|

| Online | Convenience, speed, 24/7 accessibility | Requires internet access, potential technical issues | 15-30 minutes |

| In-Person | Immediate assistance, personal interaction | Requires travel to a branch, limited hours | 30-60 minutes |

Accessibility Features for Online Application

Source: resenhanews.com

TD Bank provides accessibility features for users with disabilities, ensuring inclusivity.

These features enhance usability and improve the overall user experience for individuals with visual, auditory, or motor impairments. Features may include screen reader compatibility, keyboard navigation, and adjustable text sizes.

A step-by-step guide to utilize these features would depend on the specific features offered, but generally involves adjusting browser settings or using assistive technologies.

Account Management Features After Online Application

Source: gobankingrates.com

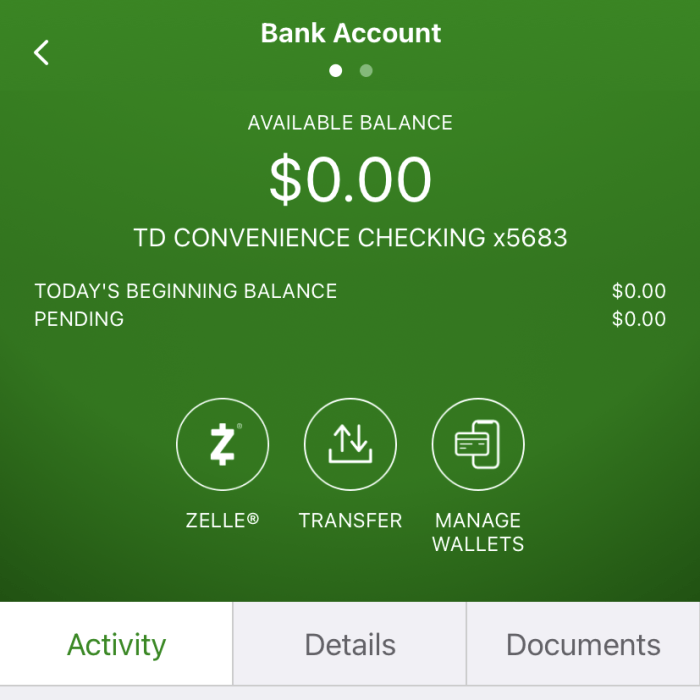

Once your account is active, you’ll have access to various online account management features.

- Online banking: View balances, transfer funds, pay bills.

- Mobile banking app: Manage your account on the go.

- Account alerts: Receive notifications for transactions and account activity.

These features provide convenience and control over your finances. For example, setting up automatic bill payments saves time and reduces the risk of late payments.

Summary

So there you have it, folks! Opening a TD Bank account online is totally doable, even for the most tech-challenged among us. Remember to keep your info safe, and don’t hesitate to reach out to TD Bank if you hit a snag. Now go forth and conquer your banking needs! Aing dah cape ngetik, ah. Sampai jumpa lagi!